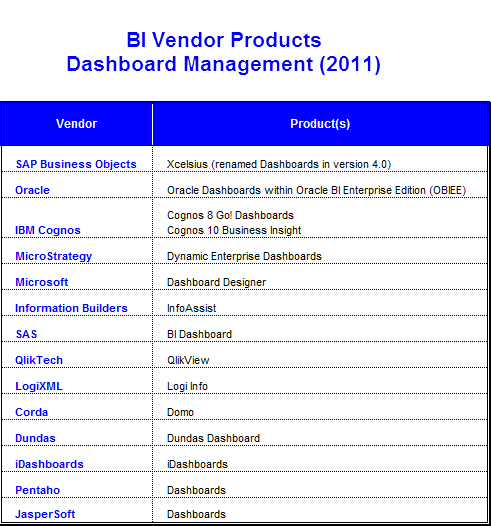

BI Market: Dashboard Management (Vendors and Products) – 2011

Dashboard management systems are intended to facilitate and support the information and decision-making needs of management by providing easy access to key business information in a highly graphical and intuitive format. Fundamentally, a dashboard is a graphical business tool that displays a set of KPIs (key performance indicators), metrics, and any other relevant information to a business user, manager, or key decision-maker in a single consolidated view and allows for organizational performance to be easily measured and monitored. Dashboard data is often displayed as aggregate information and contains data that consolidated from multiple data sources scattered throughout an organization. Dashboards are commonly interactive and provide users users the ability to drill into particular aspects of the display and/or rapidly switch between views of the data.

In 2011, the market leading vendors for dashboard management systems include: SAP Business Objects, Oracle, IBM Cognos, MicroStrategy, Microsoft, SAS, QlikTech, LogiXML, Corda, Dundas, iDashboards, Pentaho, & Jaspersoft.