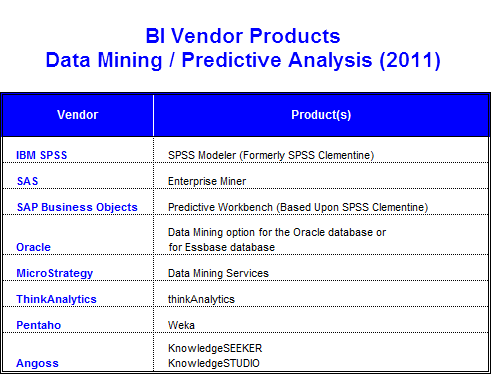

BI Market: Data Mining & Predictive Analytics (Vendors and Products) – 2011

Data Mining & Predictive Analytic solutions provide the capabilities of analyzing large data sets in order to find patterns that can help to isolate key variables to build predictive models for management decision making. In addition, data mining applications help discover hidden patterns and relationships in data in order to effectively project and predict future results. In order to accomplish this goal, data mining application utilize statistics, algorithms, advanced mathematical techniques, and sophisticated data search capabilities. Moreover, these sophisticated tools provide answers to questions that may never have been asked and they are effectively able to determine relative amounts of correlation between data elements. Further, the predictive features of these data mining tools enable organizations to exploit useful patterns in data that may have otherwise been difficult to determine.

In 2011, the market leading vendors for data mining systems include: IBM SPSS, SAS, SAP Business Objects, Oracle, MicroStrategy, ThinkAnalytics, Pentaho, & Angoss.