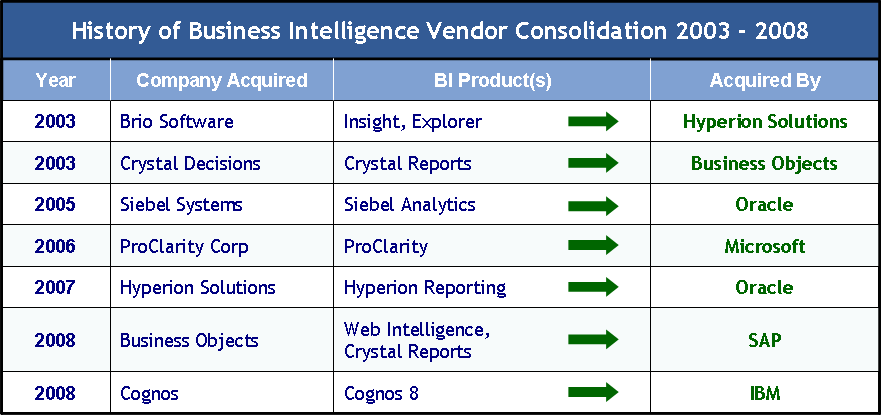

Business Intelligence Vendor Consolidation (2003-2008)

The business intelligence (BI) software marketplace has seen a wave of corporate acquisitions since the mid 1990s with the size and importance of the acquisitions coming to their apex during the years 2003 – 2008. This surge in corporate activity in the mid part of the decade has been characterized by a number of large software companies making major, strategic moves. Thus the industry is now in a state in which there are clear leaders or as Gartner, Inc puts it, “megavendors” that own a significant control over the over-all market share. In addition the rest of the BI vendors that not have been a part of acquisition activity are smaller organizations and are more commonly referred to as “niche” or “pure-play” vendors. These “niche” vendors each produce and sell viable business intelligence software products, but they do not encompass the breadth of complimentary technologies that the “megavendor” produces.

- As a result of the BI vendor consolidation of 2003-2008 the following megavendors have placed themselves in a position to control over 2/3 of the business intelligence software marketplace …

- • IBM

- • Microsoft

- • Oracle

- • SAP Business Objects